We talked about how your mind messes with your money, today we talk about solutions.

Reversing Loss Aversion

1. Reframe Losses as Opportunities

- Hack: Let’s say your client invested in a tech stock, and it dropped 15%. Ouch, right? Instead of seeing this as a total disaster, think of it as a tuition fee for an MBA in "Stock Market Realities."

Even Warren Buffett has seen stocks lose value—those experiences are packed with lessons you cant get in any school, college or university.

Or, if we’re talking taxes, that loss could be a sneaky win with tax-loss harvesting. Meaning, if you sell a something at a loss, you reduce your taxable gains, and just reinvest elsewhere. It's the financial version of making lemonade out of lemons.

- Trick: Imagine you have multiple financial goals: investing for retirement, building a college fund for the kids, and a "fun money" fund for vacations and entertainment.

Instead of having all those goals rolled into one stock and worrying that your stock loss will sink your entire portfolio, you can "bucket" these goals, so each fund is in a different stock hence isolating potential losses should certain stocks you invested in start facing some volatility.

In short, avoiding putting all your eggs in one basket can give you peace of mind.

2. Set Pre-Determined Exit Strategies

- Hack: Picture this: you jump into an exciting new crypto investment but set a stop-loss order at 20% below the purchase price.

Fast forward, the market dips, but thanks to the stop-loss, you’re automatically out before it goes any lower. You didn’t have to panic sell or sit by the computer all day hitting refresh. You’ve protected your downside with a solid, predetermined plan.

Stop-loss is when a stock trader or investor places an advance order on the stock market to automatically sell a stock when it reaches a particular price. It is used to limit loss or gain in a trade. The concept can be used for short-term as well as long-term trading.

- Trick: Use trading and investing platforms that can automate these rules so you can set the stop-loss or sell-point in advance, then let the software handle the rest. It’s like setting up a robot to watch the stock market while you relax.

3. Focus on the Long-Term Perspective

- Hack: Imagine you’re, 45 years old, feeling jittery after seeing your investment portfolio drop 10% in a week.

Take a seat and silence the noise, then walk through the vision of your financial future—at 65, lounging by a beach thanks to long-term investing. A few rough months now will be a drop in an ocean in the grand timeline. Even Amazon’s stock price dropped by over 90% during the dot-com crash, but those who held on are probably sipping cocktails on that very beach.

- Trick: Visualisation exercises. Learn picturing yourself in the future of your past and current financial decisions - 20 years from now, your financial goals achieved—maybe it’s a debt-free house or fully-funded retirement.

When you mentally “time-travel,” the bigger picture tends to sober you up and reinforce a good decision as much as it can also reveal a bad one. Realise today’s losses are temporary and part of the bigger picture.

Reversing Confirmation Bias

1. Seek Out Contradictory Information

- Hack: Say you love Tesla and think it’s the best stock in the universe. You only read glowing reports about Elon Musk and ignore anything negative. To fight this confirmation bias, dig into some bearish opinions. In fact, read about the challenges Tesla faces, like competition from established automakers or concerns about Musk’s leadership style. It’s like deliberately tuning into the station you don’t usually listen to—sure, it feels weird, but it’s refreshing to hear the other side.

Bearish in the financial world means expecting a stocks price to go down. Hence when used outside of the financial world it means a negative perspective or expectation. The opposite of bearish is bullish.

- Trick: Keep a “devil’s advocate” journal. For every decision you make, jot down reasons why you might be wrong. For instance, if you’re about to invest in a new business or stock, write: “What if their CEO leaves?” or “What if the market doesn’t take to their product?” By acknowledging potential weaknesses, you’ll approach your investments with a more balanced perspective.

2. Diversify Decision-Making Inputs

- Hack: If you usually consult only one advisor or read a single financial news source, mix things up. Get input from a few different sources—ask a second advisor, check out different financial publications, or bounce ideas off peers in an investment group. Like getting second and third opinions from doctors, a variety of perspectives leads to better decisions.

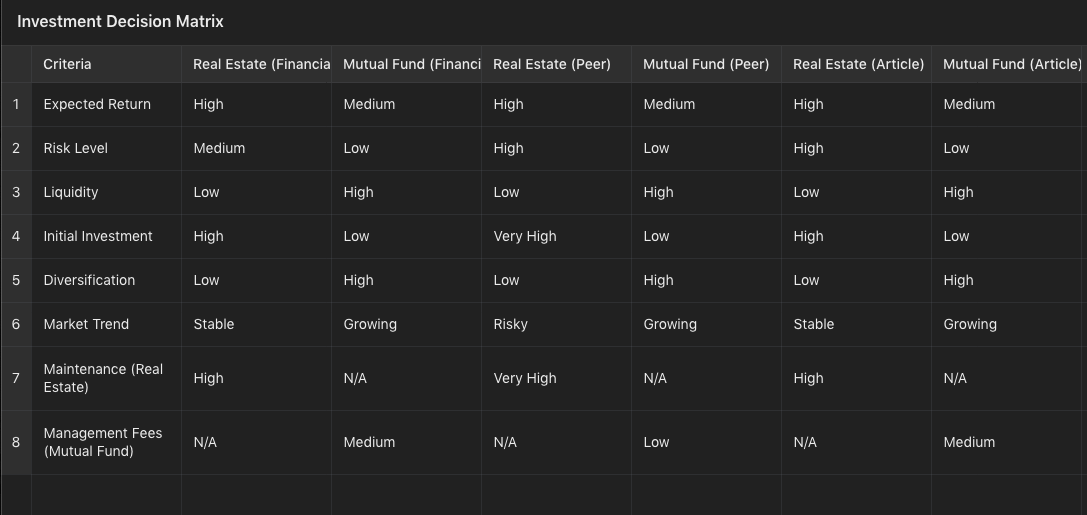

- Trick: Use a decision matrix. Let’s say you’re deciding whether to invest in real estate or a mutual fund. In the matrix, list pros and cons from different sources: financial advisors, articles, or peer opinions. Rank the advice based on credibility and relevance, which helps dilute any single biased source. It’s like comparing product reviews before buying that new gadget.

Decision Matrix

3. Set Bias Breaker Triggers

- Hack: Before any big investment, go through a checklist with questions like, “What if I’m wrong?” or “Have I thought about the opposing view?” This checklist forces you to pause and rethink whether you’re acting on hype.

- Trick: Set up regular “bias check” meetings. Maybe quarterly, sit down with your spouse, friend or advisor to review your portfolio. The goal: identify any decision made out of pure bias. For example, maybe you invested heavily in a single stock because you loved the company, not because it was the smartest financial decision. Investments and emotions don’t go hand in hand.

4. Use Pre-Mortem Analysis

- Hack: Pre-mortem analysis is all about imagining the worst. Say you’re excited about buying a rental property. Pretend it’s five years later, and the property is a financial disaster—vacancies, expensive repairs, low market demand. Work backwards and pinpoint what went wrong. Maybe you’ll realise you didn’t account for rising interest rates, vacant months or maintenance costs. This exercise forces you to see potential pitfalls before you leap.

- Trick: Role-play as your harshest critic. If you were pitching the investment to yourself, what arguments would you make against it? Maybe you’d say, “I’m overestimating rental income,” or “The location isn’t as great as I think.” This perspective shift helps you catch flaws you might’ve missed.

General Cognitive Strategies

1. Mindfulness & Emotional Awareness

- Hack: Mindfulness isn’t just for yoga class—it’s for finances too! Let’s say you get jittery every time the market dips. Learn to take a moment, breathe, and acknowledge that feeling of panic before you act on it. By recognizing your emotions, you’re less likely to make rash decisions.

- Trick: Try “financial meditation” . Once a month, reflect on a recent investment or any financial decision and how you felt during the process. Did you feel overconfident? Were you nervous about losing money? Journal it. Over time, you’ll spot patterns in your emotions and learn to manage them better, turning those gut reactions into thoughtful decisions.

Implement these hacks and tricks to reverse biases and make smarter more mindful financial decisions.